Private Equity Marketing in the Digital Era: What Works Today

Private equity marketing is most often associated with on-site promotions, personal networks, and offline roadshows. But the 21st-century digitalization wave has swept over every aspect of human life, and it hasn’t left the equity marketing stone unturned, either.

In this post, we’ll explore the transformation of the private equity fundraising business, illuminating what has changed and which digital marketing strategies proved most impactful in this new, digitized world.

Curious to know how private equity marketing has changed — and what works today? Keep reading.

The evolution of private equity marketing

Let’s first clarify the concept of equity marketing (in case you didn’t know) and then see how the digital revolution has transformed its essence, approaches, and channels.

The definition of equity marketing

Private equity marketing is formally defined as a set of marketing strategies utilized by private equity (PE) companies to raise capital from investors to promote their funds.

The investors in this business model are usually called limited partners (LPs), and they don’t pay anything to the PE firms; they just invest their funds.

Investors do benefit from the fees they receive from PE companies. The former earn those fees by reinvesting the raised funds in other companies (called portfolio companies), aiming to develop and grow them, often modernizing and restructuring along the way.

LPs can vary by size and industry, and represent high-net-worth individuals, pension funds, sovereign wealth funds, family offices, and others.

Therefore, the goals of a PE firm are multifold:

- Raising funds.

- Promoting its portfolio of companies (in which they reinvest money).

- Building and supporting the brand reputation of a self as a trustworthy investment entity.

- Maintaining relations with investors who commit their funds.

The word "marketing" in this model encompasses several strategies and approaches, including a firm’s promotion, investor pitches, conferences, roadshows, and one-on-one meetings, as well as PR and media relations, digital presence, and thought leadership.

From handshake deals to digital-first strategies

There was a time when fundraising lived in hotel lobbies and quiet lunches. Those still matter, but the first “meeting” now happens on your website at 11 p.m. when an LP is doing homework.

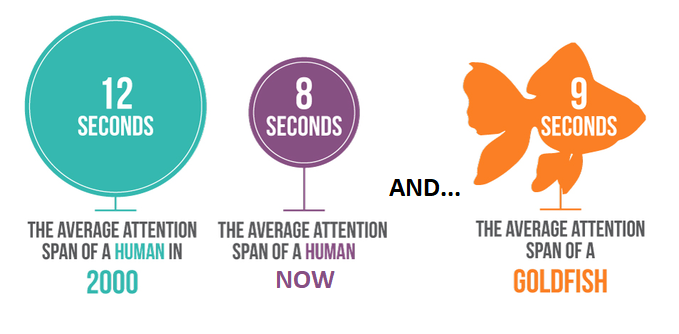

Attendees are picky, and their attention is scarcer than ever. If they can’t understand your focus in a minute, they won’t book the coffee.

Also, the old marketing path was linear: event, meeting, follow-up. Now the path loops. An LP reads your thesis, checks a case, looks up a partner’s background, and only then answers your email. If the story hangs together, the reply is quick.

Equity firms must write their pitches for people who are always busy and on the run. Plain English beats slogans every time. They share how a source deals, what they look for, and the two or three operating levers they know best.

Digitalization hasn’t meant “more volume”; instead, private equity firms now focus on fewer, richer touchpoints. Their communication style is marked by:

- Fewer, richer updates. Communications focus on one theme and a handful of concrete insights.

- Operator-centric detail. Practical levers — pricing, procurement, working capital — take center stage.

- Compliance-shaped public voice. Tone favors process explanations over performance discussion.

- Discovery via search. Clear site architecture and SEO make core materials easy to find.

- Data-informed refinement. Content is iterated based on actual reading patterns, not guesswork.

- Rebalanced budgets. Marketing investments migrate from travel-heavy roadshows to digital proof points.

The modern relationships between equity firms and their investors are characterized by asynchronous first contact, meaning that investors don’t wait until firms contact them officially; they can gather information and form the first impression by checking the company’s website, public mentions, and other investors’ feedback.

That’s exactly why most modern visibility approaches, such as SEO, social media marketing, and digital ads, are all highly effective and are eagerly used by most forward-looking PE firms.

Why traditional fundraising models no longer suffice

Calling for an on-site meeting and expecting the same promotion effect as it was in the 90s or earlier is naive and fruitless. Today, visibility and awareness are built online.

Furthermore, if a private equity firm has a splendid website with exhaustive information about its operations, the benefits for potential investors, and strong liability policies, but no one in the team has thought about SEO, that’s a sure losing game as well.

For years, capital raising for private equity firms leaned on proximity: dinners, site visits, repeat introductions. Today, distance is normal and discovery is digital. LPs want to understand strategy and repeatability before they invest time, not just money.

The attention window is shorter, too. Analysts scan a thesis on a phone between meetings, then pass a link to colleagues. If the narrative doesn’t hold up in two or three clicks, it rarely makes the agenda.

Source: Griffonwebstudios

Digitalization changed expectations. Comparable case snapshots, identical KPI layouts, and simple governance notes let teams compare managers quickly. That favors firms with organized, shareable proof over those with heavy decks and long speeches.

There’s also a tone shift. Fund marketing in private equity reads calmer and more process-led in public, because compliance and respect for context come first. Those signals help committees trust the work behind the numbers.

Traditional investment marketing models still help relationships, but they no longer do the heavy lifting. The main filter and primary communication channel are digital, and they remain constant.

Digital investor relations platforms

Serious investors demand transparency and frequent reporting. They also expect professional communication via specialized platforms, not just Messenger or Slack calls. In this chapter, we’ll review how secure portals and real-time reporting help build trust and enhance transparency for private equity marketing.

Building trust with secure portals and dashboards

Digital investor relations platforms have become the front desk for fund marketing in private equity. They welcome people in, point to the right rooms, and make sure sensitive documents don’t wander. The tone is calm and professional, which is exactly what committees expect.

Previously, capital raising for private equity firms used to begin with a meeting. Today, it often starts with a login. A secure portal signals care; a tidy dashboard signals clarity. Together, they ease tensions, lower costs, and set expectations before anyone speaks.

Good portals also reduce uncertainty. They come with many modern features that improve communication and understanding, e.g., session recordings and transcription (plus translation to any language in the world), enable file upload and download, allow making and monitoring changes in the shared documents, to name a few.

No hunting, no guessing, fewer side emails.

When firms talk about “what good looks like,” they often mean:

- Clear front door (first page). Strong authentication that still feels simple.

- One source of truth. Strategy, cases, and governance in known places.

- Version discipline. New uploads replace, not multiply.

- Context next to data. Short notes explain results in plain language.

- Permission tiers. Advisors, LPs, and auditors get tailored access.

- Dashboard first view. Headline KPIs, then links for depth.

A good dashboard doesn’t try to say everything. Remember, attention is limited, and too many data and metrics can actually harm, instead of adding value.

Your dashboard should frame a few KPIs, flag what changed, and point to the right documents. People can skim, then choose their depth.

In this world, “marketing to investors” is less pitch and more access. Secure portals and clear dashboards make the path from interest to understanding feel straightforward.

How real-time reporting enhances transparency

Investor relationships require moderation and frequent reporting. The first is easier with a skilled and experienced facilitator who would schedule and run meetings, while the second can be done during those meetings, plus frequent, real-time reporting in between the meetings.

From the communications point of view, real-time reporting is about closing the information gap without creating noise. When important updates are generated and disseminated quickly, committees can map actions to outcomes while decisions (and data) are still fresh.

Curious to know a simple yet effective reporting setup for maximum transparency? Here is one:

- Unified source. When your finance and ops departments feed into the same portal.

- Locked history. All amendments are disclosed, not buried in the trash folders.

- User cues. “New since last visit” saves time.

- Variance drill-downs. Start with summary numbers, then explore the details behind changes.

- Permissions that fit roles. Each user sees only the level of information needed.

- Plain language. Complex ideas are explained with clear, everyday words instead.

For capital raising for private equity firms, that reliability becomes part of the reputation. Prospective LPs see the same discipline that existing LPs experience. The result is a calmer, more predictable relationship from first login until the fund is fully subscribed and closed.

Content marketing for private equity firms

Much of investment marketing communications is happening online. And a big part of these communications stipulate building awareness and visibility through high-authority resources, such as partner websites, influencer blogs, and social media.

Content marketing covers these aspects effectively and at an affordable price.

Using content to build trust and position a firm as an authority

People, especially respectful investors, rarely believe slogans and short promotional videos. They need proof, through reason and hard facts. Private equity marketing utilizes content to give investors the proof they need, which helps to establish a PE firm as a trustworthy investment partner.

Strong content lowers uncertainty. It shows the plan, the actions, and the results without drama. LPs can map what they’re reading to the kind of diligence they already do.

Authority, here, is the result of consistency. If every case follows the same structure and every metric is defined once, people stop guessing. That steadiness is a quiet advantage in fund marketing in private equity.

The most effective building blocks tend to be:

- Clear thesis notes. Sectors, check sizes, and guardrails in simple form.

- Replicable case layouts. Baseline → actions → outcomes, repeated across deals.

- Short operator memos. What moved the needle operationally, in two paragraphs.

- Governance snapshots. Who approves what, a clear outline of decision-makers, and the boundaries for acceptable risks.

- KPI sheets. A few metrics that recur quarter after quarter.

- Committee-friendly links. Materials that open fast and are easy to forward.

When these blocks are in place, investment fund promotion feels like good housekeeping. People spend less time reconciling versions and more time discussing the difference they can make and evaluating fit. That’s how authority accumulates — one clear artifact at a time.

How guest articles on industry sites attract new investors

In the past, traditional PR and marketing relied on newspapers and magazines to reach their audience. Today, digital marketing utilizes industry websites to target very specific investor groups. The performance of this modern method surpasses traditional marketing by far in terms of cost, speed, and reach.

One highly potent method they use is called guest posting. PE firms choose relevant industry sites, pitch their ideas to site owners and editors to establish partnerships, and post guest articles with relevant content.

Source: Heytony

The purpose of the content can be multifold:

- To educate the audience, inform, and build awareness.

- To establish trust and credibility in the PE firm.

- To generate traffic to the PE firm’s website by utilizing strategically positioned backlinks.

- To showcase sector expertise with real examples and insights.

- To reach new investor groups through respected third-party platforms.

Backlinks, in this case, help to build authority by signalling to Google and other search engines that the PE firm’s site is cited by the leading industry resources and people actually follow these links, and increase referral traffic.

Guest pieces work because they borrow trust from respected outlets and meet readers where they already pay attention. They’re searchable, shareable, and easy for analysts to pass along inside a committee without extra context.

Here’s how guest articles draw investor interest in practice:

- Borrowed credibility. Reputable outlets transfer some trust to the authoring firm.

- Focused audiences. Niche sites gather LPs and advisors who follow that sector.

- Clear path onward. Links guide readers to IR pages or case studies.

- Portable proof. Articles are easy to forward in diligence threads.

- Steady voice. Plain language signals discipline over promotion.

For private equity fundraising, the effect is subtle but important. Readers meet the team’s thinking style and see how claims are supported.

That tone also supports fund marketing in private equity. The article stands on its own, yet points to deeper proof for anyone who wants it.

In combination with other private equity marketing strategies, guest articles contribute to better SEO and keep the door open. They let investors approach on their timeline and with fewer doubts.

Storytelling and case studies to showcase the portfolio

Limited partners of private equity firms often include big pension funds, sovereign wealth funds, family offices, and wealthy individual investors. Before committing their money (often substantial sums), these people want to be sure they’re doing the right thing and that their money will be “working” and yielding dividends. In other words, they need hard proof.

Case studies and stories told by the CXO positions within PE companies in personal meetings can deliver that proof convincingly and effectively. But even before you get to the communication part, how do you ensure that your cases are built to succeed?

By building each case with these pieces:

- Context first. Size, market, and key constraints in a few lines.

- Thesis, plain English. Why this deal made sense.

- Three moves. The main actions and their intent.

- Before/after. KPIs shown simply, with definitions nearby.

- Risk handled. Oversight, case limits, and governance, imposed by you

- What’s next? The remaining work or exit logic.

This format works in a portal, a PDF, or a short talk. It doesn’t matter what channels you use; the same effective story will be delivered.

Used consistently, these stories help private equity fundraising start further along. Oftentimes, people see your methods before they meet the team. And when they do meet your team or chief executives, they come “warm”, not “cold”.

The importance of social media presence

Virtually no business model can survive without social media in the digital era. PE firms and their fundraising efforts are no exception. The key peculiarity here is that not every social media platform is good or appropriate for equity marketing. For instance, Facebook or Instagram won’t work as well as LinkedIn, because the former is where most business people get together and stay online for longer hours.

LinkedIn as the central hub for investor engagement

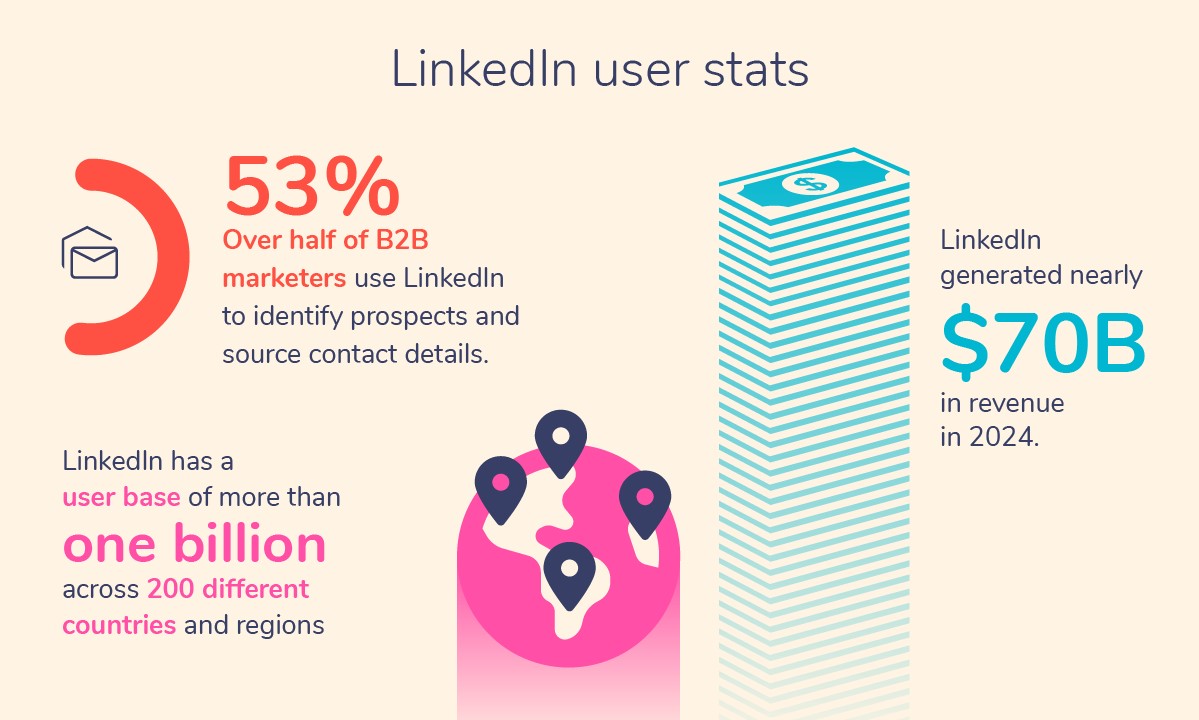

For many investment firms, LinkedIn has replaced the conference hallway as the place where first impressions form. It’s where analysts skim a thesis, partners scan a case, and boards click through to your portal.

The audience is both large and relevant: LinkedIn reports more than 1 billion members worldwide, which is a meaningful surface area for discovery.

Source: Sopro

What makes it useful for private equity fundraising is the mix of scale and context. Profiles, company pages, and thought pieces live next to each other, so an LP can connect claims to people and proof. Add to that the fact that 40% of U.S. adults aged 30–49 use LinkedIn, a segment that includes many mid-career decision-makers.

This is why LinkedIn matters for investment business, including private equity firms:

- Credible discovery. Real identities and work history reduce noise.

- Portable proof. Articles and case links are easy to share internally.

- Warm context. Posts show how a team thinks, not just what it says.

- Soft calls to action. IR pages and portal requests sit one click away.

- Sector communities. Niche conversations gather the right readers.

For capital raising for private equity firms, this means that the first contact often happens without an email. People read, compare, and only then reach out. Used steadily, LinkedIn complements investment fund promotion by letting substance travel — your ideas, your operators’ notes, and your portfolio stories — where investors already spend time.

What role niche platforms can play

Niche platforms have that name for a reason — they are less about scale and more about fit. They gather operators, advisors, and LPs around a common vertical or theme, which raises the baseline knowledge of every reader.

The result is a better understanding, everyone stays on the same page, and occasionally contributes to the discussion. The comments teach as much as the post.

For investment fund promotion, that’s helpful. A governance note or a before/after KPI snapshot can sit among peers who understand the trade-offs.

Their role usually shows up like this:

- Context-rich space. Everyone shares a vocabulary and a problem set.

- Lower friction. You can skip the basics and get straight to the point.

- Credible environment. With proper moderation and standards, you can keep things tidy.

- Direct follow-through. Sharing investor relations links on niche platforms feels natural and accepted.

- Useful archives. Threads remain available for future diligence.

Capital raising for private equity firms runs better when all readers, especially the newcomers, are aligned. Niche platforms produce that alignment by default. A small audience, but the right one.

From a spending perspective, they often make modest budgets work hard. You’re funding depth, not breadth, which can be a smart shape for marketing investments. Pair that depth with a broad discoverability channel, and both sides improve.

SEO and discoverability

Traditional private equity marketing firms have a reputation for being clumsy and slow. They spend big money on ads and PR, and as they transition into the digital domain, they often overlook one impactful, yet affordable tool for building visibility and acquiring new LPs — search engine optimization (SEO).

Let’s review how website optimization helps rank higher in searches and attract new investors, and how to not violate the confidentiality rules while chasing maximum visibility.

Optimizing websites for investor-related searches

SEO for investor discovery is about a system of organized actions, performed continuously, where everything starts with the quality of on-site content.

Write like an analyst would: state the thesis, show the evidence, explain the guardrails. That style serves search engines because it serves readers.

Device habits nudge priorities, too. In the U.S., Safari and Chrome together account for over 92% of mobile browsing, so testing pages on both keeps the experience consistent where it matters most.

Here is how PE firms can map that reality to concrete web actions:

- Use fast, readable mobile layouts with text-first content before heavy images or animations.

- Optimize images and videos for small screens and varied connection speeds.

- Use question-style headings that echo investor queries about sectors, stages, and value-creation levers.

- Build repeatable case pages with the same KPIs, charts, and a short narrative beside results.

- Publish definitions for recurring KPIs, so metrics mean the same thing across pages.

- Title pages around investor questions, like “pricing power in specialty healthcare roll-ups” for relevance.

Done well and enhanced by the relevant SEO software and tools, this supports fund marketing in private equity by making real answers visible. It also reduces back-and-forth, because your site already addresses the questions investors bring — and surfaces the ideas they came to find.

The benefits are apparent for both investors and search engine optimization, as a site with structured, highly relevant, and up-to-date content becomes a favorite crawling target for Google’s bots and enjoys higher positioning on its front search page.

Balancing visibility with confidentiality requirements

Obviously, PE firms pursue more visibility of their business and investment opportunities, as this is what marketing is all about. You cannot do marketing successfully while staying hidden.

On the other hand, investors want more security for their funds and confidentiality of their personal information. In fact, many LPs specifically demand to stay invisible, anonymous, and often sign relevant Non Disclosure Agreements (NDA).

Utmost secrecy isn’t necessary. Instead, aim for sensible boundaries. Consider building walls made of glass and doors locked tight with the best materials. It means that only the insiders should have access to the details (important files and documents), while the outsiders can easily distinguish the general structures, shapes, and silhouettes.

Visibility earns interest, while confidentiality protects people and positions.

A beginner-friendly blueprint looks like this:

- Publish the “how,” not the “who”: explain methods and approach clearly, but don’t name involved companies.

- Aggregate results: Show overall portfolio performance trends without revealing individual company results.

- Delay disclosures: Share deal details only after they’re officially finalized.

- Use controlled portals: Sensitive files accessible only through secure, permissioned platforms.

- Label audiences: Clearly mark what content is public or restricted access.

- Anonymize anecdotes: Tell lessons learned without including names or dates.

- Centralize approvals: One person reviews and approves all external communications.

Handled this way, fund marketing in private equity can raise the firm’s profile without exposing LPs or live deals. Public materials teach the method; gated materials prove it.

For capital raising for private equity firms, that separation builds comfort on both sides. LPs see discipline; prospects see enough to judge fit — without the firm oversharing.

Video marketing in private equity

Video marketing plays a big role in marketing in any industry and sector, and in the private equity domain in particular. Why? Because traditionally, PE firms relied on in-person communications to build trust and establish partnerships, while in the digital era, video serves this purpose perfectly.

Marketing for private equity firms thrives on video content that helps it to build visibility, establish trust, and conclude contracts.

Engaging investors through webinars and interviews

A good webinar feels like sitting in on a working session. It shows how a thesis turns into actions, and how actions turn into results. Interviews add tone — how leaders reason through uncertainty and trade-offs.

Webinars don’t run by themselves, though. Schedule and conduct one only when you have prepared well and are yourself a good facilitator, or have one in your team. Virtual meetings lack the engagement of their physical counterparts; hence, the main role of the facilitator is to keep the audience actively involved and frequently contributing to the discussions.

The following techniques work the best:

- Ask all participants to introduce themselves briefly as the meeting starts.

- Occasionally alternating tone of voice, making big pauses when appropriate, and mixing textual, graphical, and video content while presenting.

- Use polls or quick surveys to gather views and keep participants actively engaged.

- Summarize key points regularly to make sure everyone stays on the same page.

- End with a clear Q&A session so participants can raise specific concerns openly.

Video has the audience to justify the effort. Ofcom’s 2024 Online Nation report highlights the central role of online video in everyday media use, reflecting habits that carry into professional research and diligence.

Here are some additional ideas on how these sessions typically work best:

- One topic, one story: focus on a single sector shift or value-creation lever.

- Evidence on screen: show before/after KPIs with two lines of context.

- Clear handoff: point serious viewers to IR materials and next steps.

The effect is practical: fewer emails, fewer misunderstandings, and a faster path to a real discussion. People arrive knowing the method and the boundaries.

For private equity fundraising, this turns first contact into informed interest. Webinars and interviews show the team’s thinking — not just the outcome — and that’s often what investors want most.

Why visual storytelling builds stronger connections

Let’s unveil the curtain behind the effectiveness of visual storytelling in private equity marketing.

For centuries, people have met eye-to-eye to conclude important contracts and make agreements. That’s the natural and intuitively credible source of communication that endured the industrial and now the digital revolutions.

Modern investment marketing uses many communication channels, including emails, social media, and guest writing. But visual storytelling is the one that earns more trust and helps to acquire more customers (investors) than any other channel.

Source: Comms8

Here is what psychologists and neurobiologists say about the effects of visual storytelling on building human connections:

- Faces trigger fast attention; micro-expressions build trust faster than text alone.

- Stories engage emotion and memory, helping details stick during later decisions.

- Visuals reduce cognitive load, making complex ideas easier to grasp quickly.

- Narratives with images improve comprehension by combining verbal and visual pathways.

- Motion and voice cues signal authenticity, increasing perceived credibility and warmth.

In short, it's better to prepare one short video clip about your PE business and disseminate it through partner channels and industry portals, than sending thousands and thousands of emails or writing dozens of posts.

Reputation management in the digital space

A big part of what the potential investors see and hear about a PE firm is what PR specialists call a reputation. It can be positive or negative, and is formed by the firm’s deliberate communication, marketing, concrete results/actions, and customers’ feedback and reviews.

Reputation management as a pillar of private equity trust

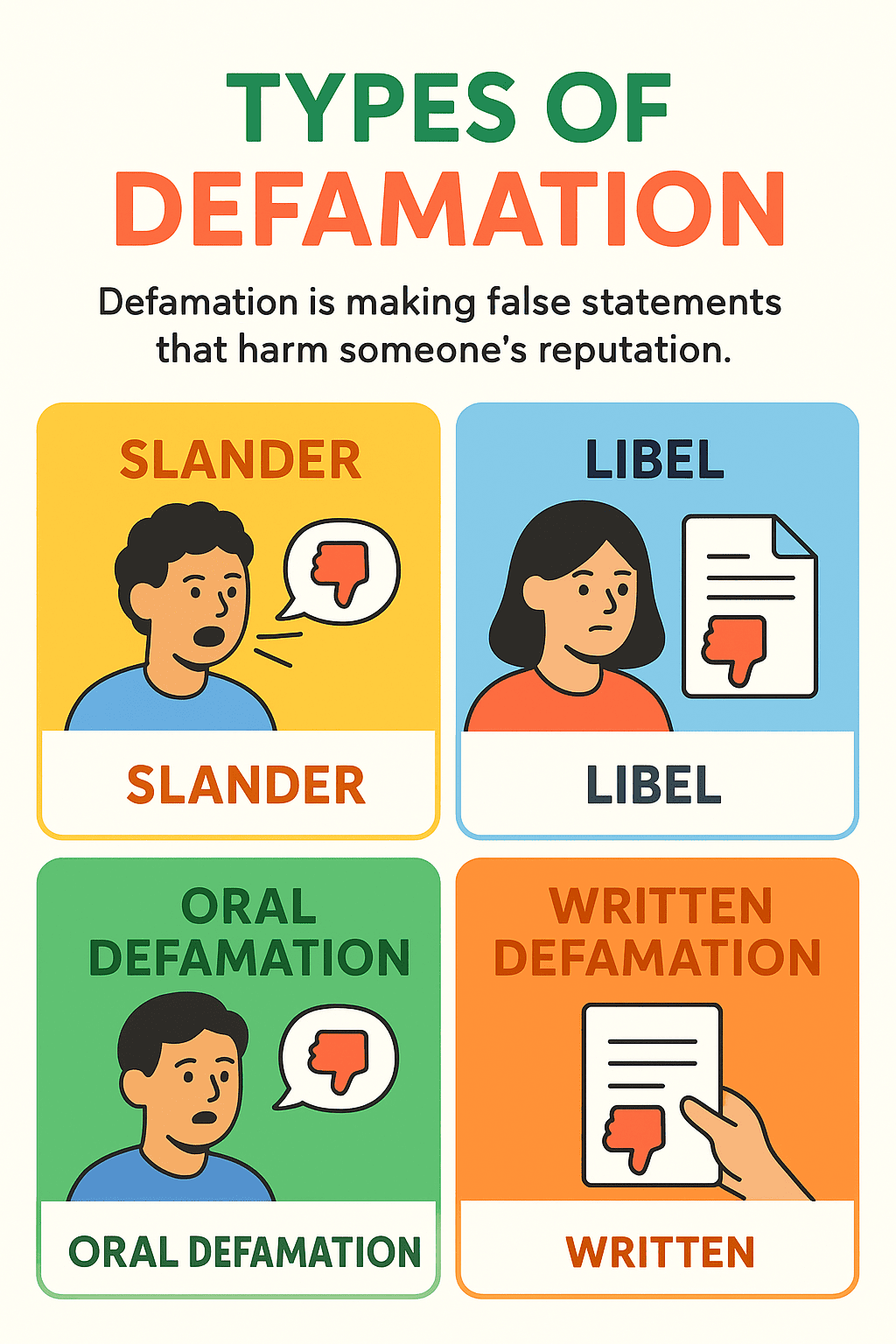

A positive reputation likes and rewards managing and nurturing, but it punishes a neglectful attitude, oblivion, and the “let things be as they are” attitude. Defamation and reputation crises happen far more often than most people think. Even with great business results, a private equity company can easily fall prey to the targeted slander spread by the envious rivals.

Investor marketing has to take all that into account and proactively manage reputation. That includes:

- Monitoring any public mentions of the PE firm name and its top management.

- Prepare and rapidly deploy a set of crisis mitigation actions (swift replies to public comments, dissemination of messages and posts aimed at amending the damage done) should the crisis develop.

- Establish a single spokesperson and approval workflow for all outward-facing statements.

- Maintain a public “facts and updates” hub with statements, FAQs, and supporting documents.

- Build relationships with trusted financial and trade media before any crisis arises.

- Train executives and staff on disclosure and social guidelines to prevent accidental misstatements.

In reputation management, it's better (cheaper) to prevent the damage from occurring than to deal with damage repairs. Unfortunately, many PE firms follow the worst path and, in that case, they must be prepared that a successful reputation may never be fully restored.

Monitoring and managing press coverage

To prevent the irreparable damage and extra costs it entails, the private equity digital marketing team has to constantly monitor the main press sources related to the company’s activities. Sometimes, even the general online press sources become hungry for any negative news about investment funds. So, they too must be watched closely.

In the event of the slightest libel, the PE’s corporate communication department must respond promptly with debunking messages and articles, by contacting relevant press sources and providing proof of the libel occurrence.

Oftentimes, a far better tactic is prevention. If a slander or libel occurs against a PE company that doesn’t communicate often with the press and media, that defamation usually does significantly more damage, and repairing it becomes really hard.

However, if a company establishes a strong preemptive communication, showing its activities in a favorable light and to a wide audience, it creates a defensive wall against any potential defamation threats. Breaching that wall is much harder, as a company already has a strong positive reputation.

It's like a healthy body attacked by a disease, e.g., a virus. It has fewer chances of overcoming the defensive barriers if the person has a strong immune system. And the opposite is true also — a weak organism becomes increasingly vulnerable even to trivial infections.

So, most forward-thinking PE companies nurture their positive online reputation by continuously communicating about their achievements, rewards, annual results, sponsorship, community contributions, and charity activities in the digital media and press.

Future trends in private equity marketing

Our society is standing on the edge of a far greater technological revolution than anything ever before, including the agrarian, industrial, and the recent Internet revolutions. The new, AI-driven technological progress is about to give everyone, including PE firms, an absolute cognitive abundance — a cheap source of boundless intelligence, and a superpower with unlimited potential.

By all predictions, this will change the very fabric of business communications, marketing, and capital raising, redefining how firms connect with and secure investors.

How AI-driven personalization will change investor outreach

Currently, targeting potential investors requires human resources that are always scarce. Humans already work in combination with machines (tools and AI assistants), but that “collaboration” still requires a significant amount of human time for planning, supervision, and quality checks.

One of the most time-consuming elements in that cooperation is the personalization of PE pitches. A lot of time disappears into rewriting the same points for different readers. AI can keep the message constant while tailoring the angle: highlight procurement discipline for one LP, pricing work for another, downside protection for a third.

It also manages rhythm. If someone engages more with governance than with growth, the system emphasizes oversight and risk policy next time. Personalization becomes a routine and automated process, not hard work.

The new workflow has familiar parts, just faster:

- Signal capture: notes which topics, formats, and lengths each person prefers.

- Adaptive drafts: reframes the same thesis around the reader’s priorities.

- Evidence attached: pulls the optimal evidence (charts, stats, cases) for each recipient.

- Respectful pacing: makes follow-ups based on real attention, not a calendar.

- On-demand depth: offers data-room or services links when curiosity is clear.

For fund marketing in private equity, that means less human labor and better, richer, more personalized content. LPs experience a tailored, thoughtful conversation rather than a generic campaign.

The team still decides what’s appropriate to share. Human supervision, planning, brainstorming ideas, and final editor’s control for tone compliance with the corporate guidelines are still needed. AI just makes it easy to deliver the right level of detail to the right person at the right moment.

AI-driven fund allocation for smarter capital deployment

AI can be massively helpful, not only at the planning and communication stages. In the next year or two, experts predict a mass deployment of autonomous AI regents helping PE firms allocate funds with better efficiency, speed, and higher returns.

How can AI help in practice? AI can do autonomous research of the market. It can score capex proposals, hiring plans, or pricing projects by expected lift and risk, then suggest where incremental dollars work hardest. That turns allocation into informed decision-making, not just a sourcing one.

It also helps match capital to timing. If two projects compete, the model weighs outcomes and liquidity windows, then proposes a sequence that fits the fund’s pacing. Humans decide; the math is simply prepared by AI.

Expect to see capabilities like these:

- Project scoring: rank internal initiatives by impact, cost, and time.

- Milestone gates: release funds as evidence appears, not all at once.

- Cross-portfolio effects: avoid bottlenecks in shared suppliers or talent.

- Cash windows: align spends with expected distributions and calls.

- Post-mortems: capture results to refine future recommendations.

For private equity fundraising, this is easy to explain to LPs: the firm invests not only in acquisitions, but in execution. Allocation becomes a story about where ideas turn into results, with disciplined funding and clear checkpoints.

All sides win: investors and PE firms. Everyone gets higher incomes and faces fewer risks and drawdowns, even when the market fluctuates.

Conclusion

In 2025 and beyond, private equity marketing is experiencing growth through enhanced opportunities. These opportunities have emerged thanks to the digitalization of the very PE-LPs relationships and the traditional private equity operating model.

Discovery has become digital, offering a broader scope, a narrower focus (when necessary), and certainly a much cheaper price. Guest posting and SEO help increase credibility, improve search engine ranking, and drive more high-value traffic. Compared to the old-generation PE model, this one yields more conversions as more “warm” prospects come to the right pages and get to know the company’s benefits.

Secure portals and dashboards mitigate risks and provide live reporting — the things that investors value the most at the early and mid-stages of their PE journey. That increased transparency contributes to higher trust and stronger bonds, enduring market turbulence, and the inevitable dips and downs.

Reputation management becomes more responsible and agile, as even a slight negativity or libel can grow into serious reputational damage. PE marketing teams establish proactive response mechanisms and prepare measures that stipulate building a positive corporate image in the press and media, and respond swiftly in case a reputational crisis occurs.

Finally, AI technologies are here to make even greater progress and, at the same time, disrupt the PE business model. Expect hyper-personalized investor communications, on-demand depth, and respectful pacing as the result of this transformation in the next couple of years. Autonomous AI regents will help deploy PE capital smarter and more efficiently, bringing greater wins for both PE firms and their limited partners.

All trademarks, logos, images, and materials are the property of their respective rights holders.

They are used solely for informational, analytical, and review purposes in accordance with applicable copyright law.